Expanded Accounting Equation Definition, Formula, & Example

The basic accounting equation is used to provide a simple calculation of a company’s value, based on a comparison of equity and liabilities. For a more specific breakdown of the components of equity, use the expanded equation instead. Another unique aspect of this particular equation is the component entitled “owner’s draws.” This refers to an owner’s ability to withdraw funds from a company, usually to pay salaries (including his or her own). This occurs most often in what is called a limited liability company, in which the owner is also the shareholder and no outside creditors are involved. In the case of stockholder equity, the draws to cover salaries take the form of dividends paid out by investors. The expanded equation highlights where and how these draws decrease overall equity.

- In this case the 2 accounts lie on the opposite sides of the accounting equation.

- It is important to understand that when we talk about liabilities, we are not just talking about loans.

- The first subcategory represents the owner’s stake in the business.

- This led companies to create what somecall the “contentious debit,” to defer tax liability and increasetax expense in a current period.

- For example, a company uses $400 worth of utilities in May but is not billed for the usage, or asked to pay for the usage, until June.

Equity and the Expanded Accounting Equation

The accounts may receive numbers using the system presented in Table 3.2. Another component of stockholder’s equity is company earnings. These retained earnings are what the company holds onto at the end of a period to reinvest in the business, after any distributions to ownership occur.

What Is the Basic Accounting Equation?

Buildings, machinery, and land are all considered long-term assets. Machinery is usually specific to a manufacturing business that has a factory producing goods. Machinery and buildings are often called PPE – Property Plant and Equipment. Unlike other long-term assets such as machinery, buildings, and equipment, land is not depreciated.

The Expanded Equation

- These twocomponents are contributed capital and retained earnings.

- For another example, consider the balance sheet for Apple, Inc., as published in the company’s quarterly report on July 28, 2021.

- The expanded equation highlights where and how these draws decrease overall equity.

- Access the contact form and send us your feedback, questions, etc.

- Another component of stockholder’s equity is company earnings.These retained earnings are what the company holds onto at the endof a period to reinvest in the business, after any distributions toownership occur.

The accounts are presented in the chart of accounts in the order in which they appear on the financial statements, beginning with the balance sheet accounts and then the income statement accounts. Additional numbers starting with six and continuing might be used in large merchandising and manufacturing companies. The information in the chart of accounts is the foundation of a well-organized accounting system. Distribution of earnings to ownership (shareholders) is called a dividend.

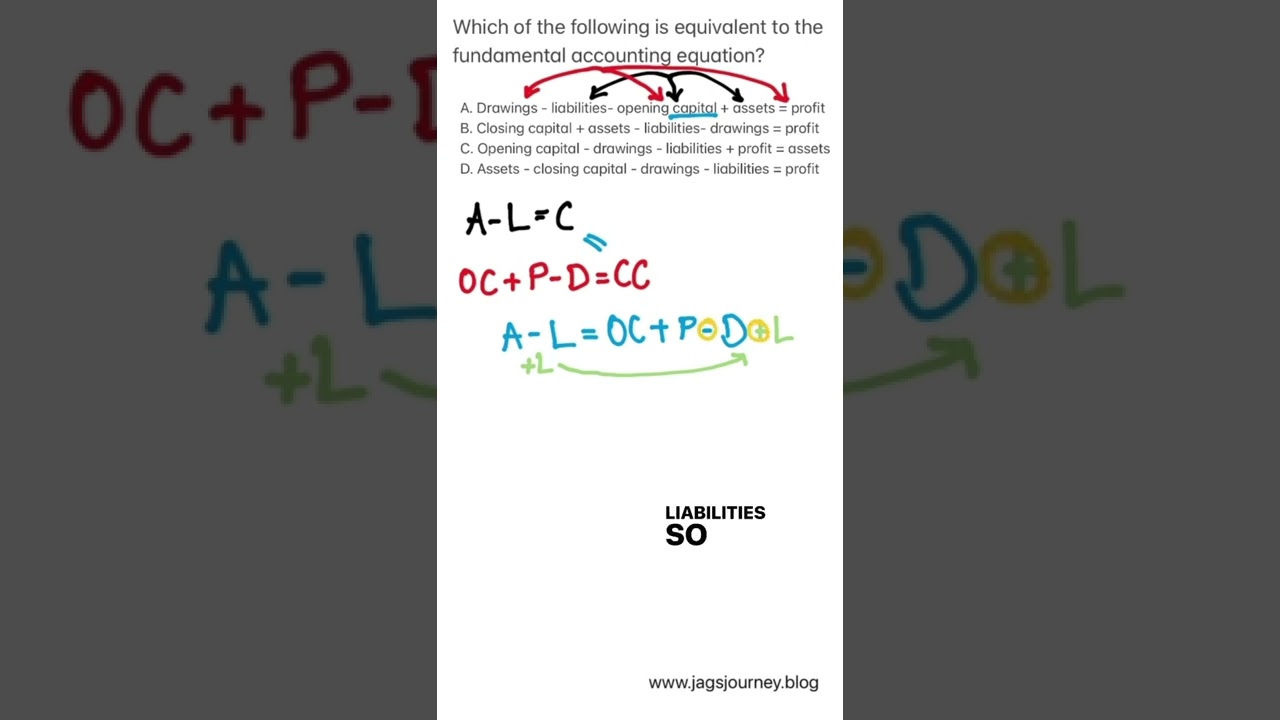

2: Define and Describe the Expanded Accounting Equation and Its Relationship to Analyzing Transactions

The the debt a firm owes to others is called a(n) is a more detailed version of the common accounting equation. It provides greater detail on the different sections of shareholders’ equity, allowing companies to see how their profits are used. The expanded accounting equation is derived from the common accounting equation and illustrates in greater detail the different components of stockholders’ equity in a company.

Example 1: Purchasing a car with cash

If you take the total of the right side of the equation (i.e. liabilities, capital contribution, income, expense, and withdrawals) you will get $36,450, which is equal to the total assets in the left side. Evaluation by CreditorsLenders and creditors can use the expanded equation to evaluate how a company allocates its funds and manages its financial resources over time. This analysis helps in assessing the company’s creditworthiness and risk profile. Here is the expanded accounting equation for a sole proprietorship. The fundamental accounting equation is debatably the foundation of all accounting, specifically the double-entry accounting system and the balance sheet.

Real-World Examples of the Expanded Accounting Equation

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. Impact of Net Income on EquityThe effect of net income on equity is readily apparent to analysts. This knowledge is essential for assessing the profitability and financial stability of the business. Notice how shareholders’ equity has been broken down in the above equation. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Expanded Accounting Equation [Definition, Formula, & Example]

Owners/shareholders can invest by contributing cash or some other asset. Cash includes paper currency as well as coins, cheques, bank accounts, PayPal accounts. Anything that can be quickly liquidated into cash is considered cash.

- There is a hybrid owner’s investment labeled aspreferred stock that is a combination of debt and equity (a conceptcovered in more advanced accounting courses).

- The increase on the asset side would be in the long-term asset column instead of the current asset column.

- Thismay be difficult to understand where these changes have occurredwithout revenue recognized individually in this expandedequation.

- This led companies to create what some call the “contentious debit,” to defer tax liability and increase tax expense in a current period.

- These retained earnings are what the business holds onto at the end of a period to reinvest in the business, after any distributions to ownership occur.

- Unlike other long-term assets such as machinery, buildings, and equipment, land is not depreciated.