HELOCs give a relatively versatile way of getting the bucks your need for a venture

You get the mortgage within the a lump sum payment of money and you will pay it back inside regular monthly payments more a predetermined count out-of ages.

If you have a large amount of house security and you can discover what the home improvement project will definitely cost, following property security loan was a good choice.

dos. HELOC

An effective HELOC, or family collateral line Ohio loans of credit, also provides another way to acquire from your own house’s security without in the process of a mortgage refinance. Additionally it is a moment mortgage however, is different from property collateral mortgage because, rather than taking right out a lump sum payment, you have usage of a great rotating line of credit to tap on the if needed.

But when you do not have the direct will cost you nailed off, you’ll have this new liberty to keep borrowing up to the financing restriction getting a set time. Its a useful way to avoid overborrowing having a primary opportunity.

Although the pricing become higher than a home guarantee financing, HELOCs offer the freedom you to certain borrowers you want.

3. Cash-away refinance

That have a money-out re-finance, you can easily take out an alternative home mortgage that substitute your current mortgage. The newest mortgage commonly move a few of your equity for the dollars which you’ll discovered on closing, and you will certainly be remaining having just one monthly homeloan payment.

Cash-away refinancing can be a good idea if you can lock during the a diminished rate of interest to suit your home loan than you’d previously. Otherwise, it is more efficient to hang onto your current reasonable home loan rate and use a unique mortgage substitute for financing the new improvements.

cuatro. FHA 203k rehab loan

Including the cash-out re-finance option, the brand new FHA 203k mortgage was a this particular brings together both the cost of the property get and also the cost of home improvements to the a unmarried mortgage. Permits you to definitely borrow on the near future worth of the fresh new home, a respect one to reflects the newest arranged renovations and you will solutions.

Generally, this type of financing is best for people to invest in a good fixer-higher. Having apparently versatile borrowing from the bank requirements and you can low-down payment selection, it’s a helpful option for of several consumers – particularly very first-time home buyers.

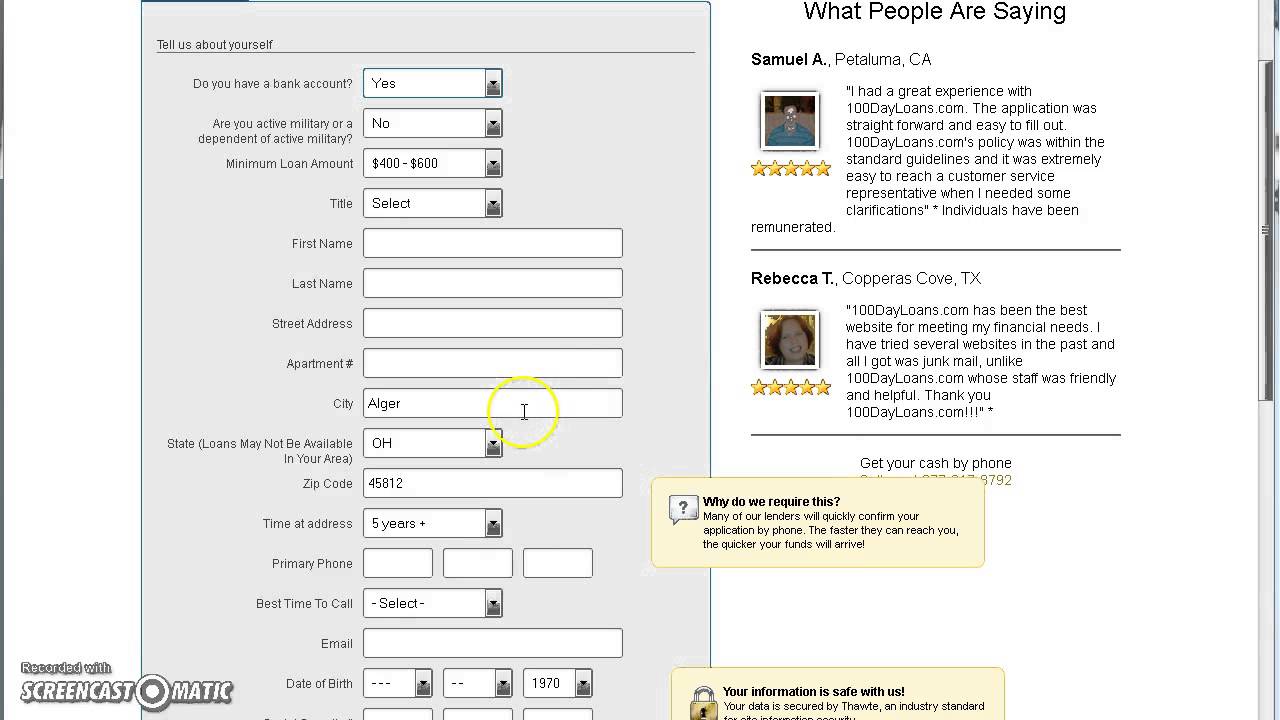

5. Unsecured loan

Particular unsecured loans promote themselves specifically once the do it yourself financing. However, even though a consumer loan is not marketed to cover family improvement can cost you, it has got an unsecured supply of finance which can be used for any objective.

Since the unsecured loans was unsecured, you won’t have to build your house because security. It means it has been faster to obtain your finance courtesy a private loan’s online software. Sadly, because they’re unsecured, you are plus browsing get high interest levels and you may a shorter payment months, which will filters your allowance.

Whether your credit history isn’t higher, you’ve got a difficult big date qualifying for it style of mortgage. Additionally, you need to extent aside any possible prepayment penalties ahead of shifting using this type of financing type.

6. Handmade cards

A charge card are an enthusiastic expedient answer to shelter do it yourself costs. What you need to create try remove their plastic material.

Even in the event it’s a simple choice upfront, borrowing costs are seemingly large having credit cards. Even with advanced borrowing from the bank, you can find high annual payment cost (APRs) that seem sensible rapidly.

Unlike a few of the other options about number, credit cards feature a changeable interest unlike repaired interest levels. Thereupon, exactly how much you pay in the desire will be different over the years.

While discussing a home improve venture that has is done quickly, a charge card even offers a primary-identity financial support service. However, following flame is going, get a hold of a loan which have less rate of interest to quit credit debt of spiraling spinning out of control.