The latest FHA kits the new financing constraints every year one determine brand new restriction count you could potentially acquire using this loan system

By comparison, you can find lowest-down-payment antique mortgage options for earliest-date homebuyers that have down payments only 3%. If not, the minimum advance payment dependence on a conventional home loan you can expect to diversity ranging from 5% in order to fifteen% according to specifics of the loan. Of course, if we need to avoid paying private mortgage insurance coverage, you’ll need to bring your own bank with an advance payment off 20% or more.

Interest rates

FHA money will get feature attractive mortgage rates of interest compared to old-fashioned loans once the government’s support of the financing reduces the chance towards lender. However,, the rate a loan provider provides you with towards both types of home loan may vary with regards to the business as well as the specifics of their financing.

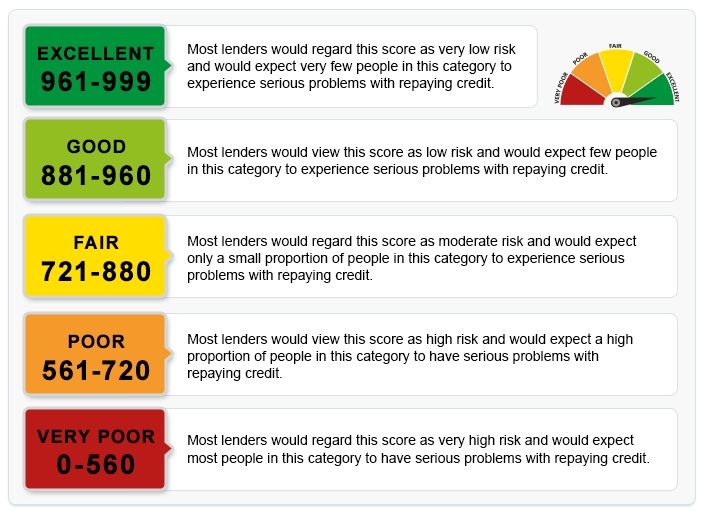

Exposure products just like your credit rating, debt-to-earnings (DTI) proportion, deposit, mortgage title, and you may if you have got a fixed-speed or varying-price home loan can also need to be considered.

Mortgage restrictions

If you find yourself looking using an enthusiastic FHA mortgage to buy a good house Website, it is critical to know the FHA financing restriction for the city. Loan limitations differ from the condition, and you may visit the HUD web site to read the FHA financial limit for several places.

- Low-pricing areas: $498,257

- High-rates areas: $step one,149,825

Compliant conventional loans supply mortgage restrictions, but they have been more than FHA loan constraints in several elements. If you’re in search of a high-costs property, a normal mortgage would-be a better fit for your role in some cities. To own 2024, conforming antique loan restrictions diversity try between $766,550 and you can $1,149,825 (inside higher-pricing areas).

The loan limitations to the conforming old-fashioned money come from the brand new work of your own Government Property Loans Agency (FHFA) to keep up stability on housing marketplace.

Federal national mortgage association and you will Freddie Mac-with each other named government-sponsored enterprises otherwise GSEs-put standards toward mortgage loans (we.elizabeth., conventional money) that they obtain lenders. New FHFA regulates the brand new GSEs and you will kits mortgage constraints on compliant money to help avoid overborrowing and foreclosures, that assist the fresh GSEs end financing expensive mortgage loans which may pose excess exposure.

Keep in mind that consumers can also sign up for nonconforming traditional finance, called jumbo loans, if they need borrow over available loan restrictions. But not, jumbo funds typically have more strict qualification criteria as the larger loan size may increase the chance inside towards the bank.

Mortgage insurance coverage

Home loan insurance is an insurance plan that provide the lending company having protection for folks who default on your financial. Which have an enthusiastic FHA mortgage, your bank will require you to definitely shell out 2 kinds of mortgage insurance-initial and you will annual.

The latest initial mortgage top (UFMIP) to own a keen FHA loan is usually step one.75% of foot amount borrowed. You can this rates to your loan amount for many who don’t have the fund available to spend initial. Yearly mortgage insurance premiums (MIP) basically are priced between 0.45% to one.05% of the loan amount. Your financial usually split the MIP superior with the 12 installment payments and create they towards the top of the monthly homeloan payment.

Antique funds can also want individual home loan insurance coverage (PMI) to protect the new lender’s financing. In case you are able to render a beneficial 20% advance payment in your conventional mortgage, you need to be able to prevent that it added cost.

PMI premium may differ based on multiple items. However, Freddie Mac computer estimates you to definitely PMI may cost between $31 so you’re able to $150 a month for each $100,000 your acquire.

This new takeaway

FHA finance and you may antique fund portray a couple additional pathways so you’re able to homeownership. An informed financial option for your position will depend on multiple products, together with your creditworthiness, your capability to keep a deposit, and how much currency you really need to borrow to purchase your need assets.