What is actually a keen FHA 203(k) Financing & Why does It Works?

An FHA 203(k) loan is a national-backed home loan that mixes one or two mortgage versions to assist money an excellent property’s get and fund the costs of the property’s home improvements. Observe how it really works to choose when you find yourself an applicant for this financing.

On this page

- FHA 203(k) Mortgage Meaning

- Exactly how FHA 203(k) Funds Really works

- FHA 203(k) Financing Designs

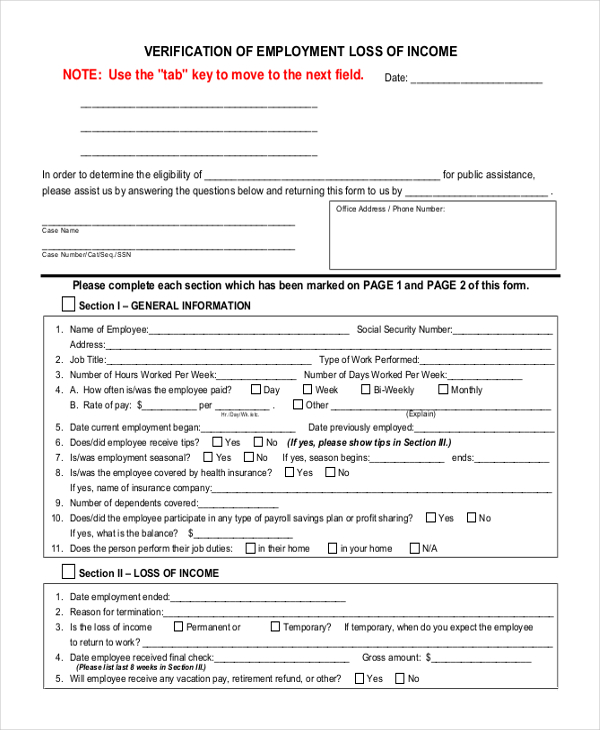

- FHA 203(k) Financing Requirements

- FHA 203(k) Application for the loan

- FHA 203(k) Loan Masters & Downsides

- Faqs About FHA 203(k) Fund

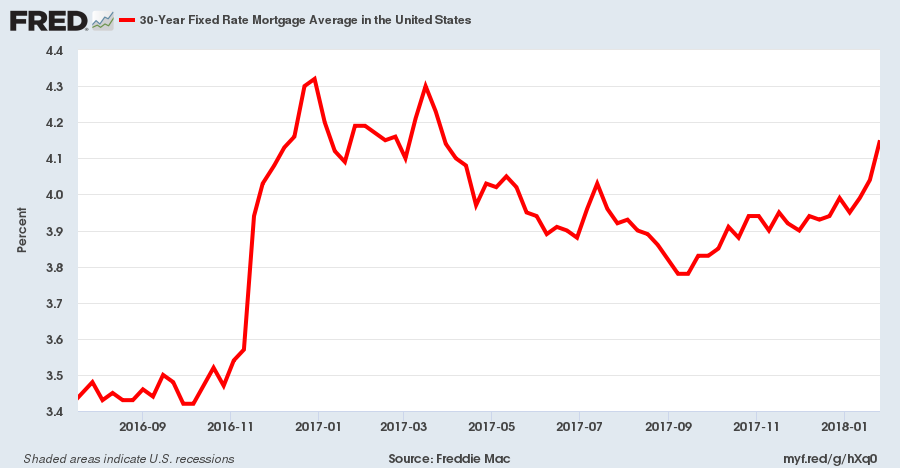

Bringing a home loan is going to be difficult. Borrowers could end with high rates of interest otherwise small repayment terms and conditions. And may only have the ability to manage a home you to needs thorough repairs. That’s what FHA 203(k) funds seek to target. These mortgage integrates a houses financing having an everyday home loan.

There are specific points whether it makes far more sense having a beneficial possible homebuyer to carry out an FHA 203(k) financing. For-instance, brand new homebuyer might want an adult home with a lower get price. Yet not, to get an old home may suggest significant structure requires. An FHA 203(k) financing can help with the fresh new repair will set you back and you can finance the acquisition rate concurrently.

Official certification are far more lenient because Government Construction Government (FHA) obtains that it loan sort of. Having said that, you will find limits towards the count and type regarding loan good homebuyer may take. On the other hand, discover rules about what rehab projects qualify.

Key Takeaways

A keen FHA 203(k) financing try a national-supported mortgage enabling potential homebuyers to own one financing to invest in a home and loans repair will cost you. This mortgage try a variety of a construction loan and you will an excellent typical financial.

There’s two particular FHA 203(k) loans: Simple and you will Smooth. The standard 203(k) loan is actually for big architectural relined 203(k) financing is actually for slight cosmetics fixes.

Potential housebuyers need to meet up with the eligibility requirements to acquire an FHA 203(k) loan. They truly are constraints into sorts of property, loan amount and you will allowed rehab ideas.

What’s an FHA 203(k) Mortgage?

The brand new 203(k) system was created to help homeowners finance the acquisition of a good assets and purchase the price of rehabilitating an identical https://paydayloanalabama.com/kinston/ domestic. The loan number boasts the cost of the home get and you may recovery.

Or even, an interested homebuyer want separate resource to get and you will rehabilitate a property in the way of a primary-label buy financing, a short-identity mortgage and you will a lengthy-title home loan. New FHA 203(k) rehab financial insurance system has the benefit of an easier option, and making an application for an FHA 203(k) mortgage is much more easy.

Aside from financial support a property get, you are able to an FHA 203(k) home loan to refinance an existing financial. New proceeds of your own mortgage may also be used with the treatment of your own borrower’s domestic.

An example of a position where taking out an enthusiastic FHA financing is a superb option is if property enjoys suffered good federally stated sheer disaster. In this case, you might have to conduct fixes or home improvements to your home. To fund the expense, you can get an FHA mortgage.

Yet not, you will need to note that loan limits may differ based on area and diversity. The kind of 203(k) program in addition to establishes simply how much a debtor could possibly get. There’s two models available – Standard and Smooth.

A standard 203(k) mortgage is generally useful thorough solutions or building work. There’s absolutely no limit restriction toward repair count. Meanwhile, a streamlined 203(k) loan is appropriate for lesser renovations otherwise non-architectural solutions. Because of it types of, the brand new repair matter getting a job cannot go beyond $35,100000 quite often.